Behind the Buzz: Unpacking How A Hemp Drink Brand Accidentally Went Viral On Twitter

It's not every day that reefer madness helps to sell CBD drinks, but welcome to 2024.

Aloha and welcome back to CannabisCMO!

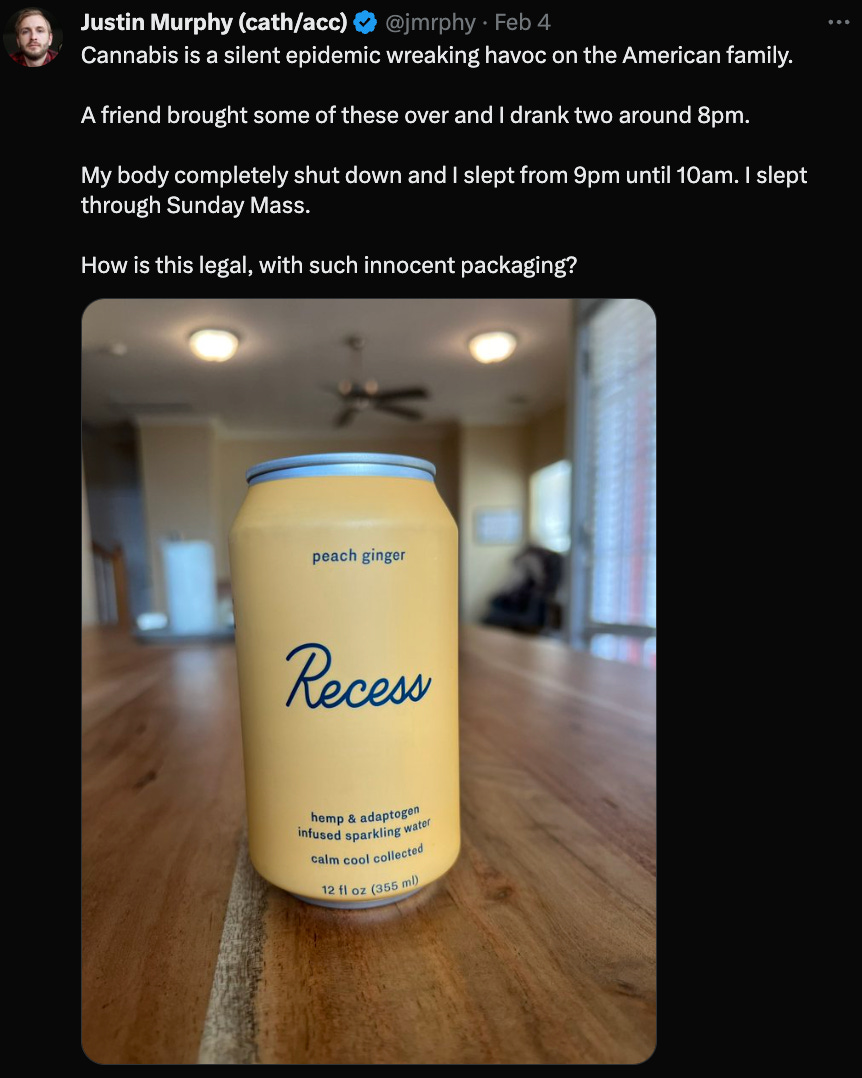

I don’t know if you spend a lot of time on Twitter (I still refuse to call it X), but the chances are that if you do, you saw this tweet go viral earlier last week:

There. are. so. many. layers.

First, the obvious question: was this a serious tweet or was it satirical?

If it was serious, this part of the tweet reeks of reefer madness: “cannabis is a silent epidemic wreaking havoc on the American family”.

If it was satirical, then it was pretty funny.

Either way, since you’re reading this newsletter, the chances are you understand that CBD beverages are harmless (although largely unregulated) and don’t have the same effects as THC beverages.

I mean, have you ever consumed enough CBD to knock you out for 11 hours?!

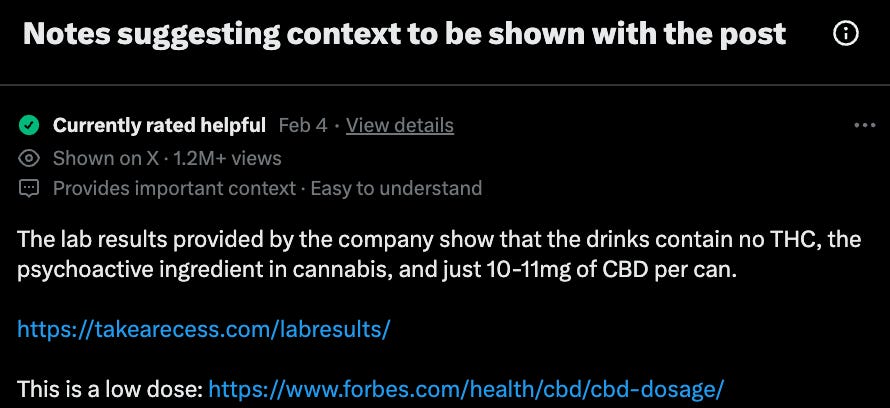

Here is the “Community Note” that appeared under the original tweet linking to lab results that show that each can is only 10-11mg of CBD:

I gotta admit, when I first read it, I thought it was written by a prohibitionist who got duped into drinking a couple CBD drinks and then over exaggerated its effects.

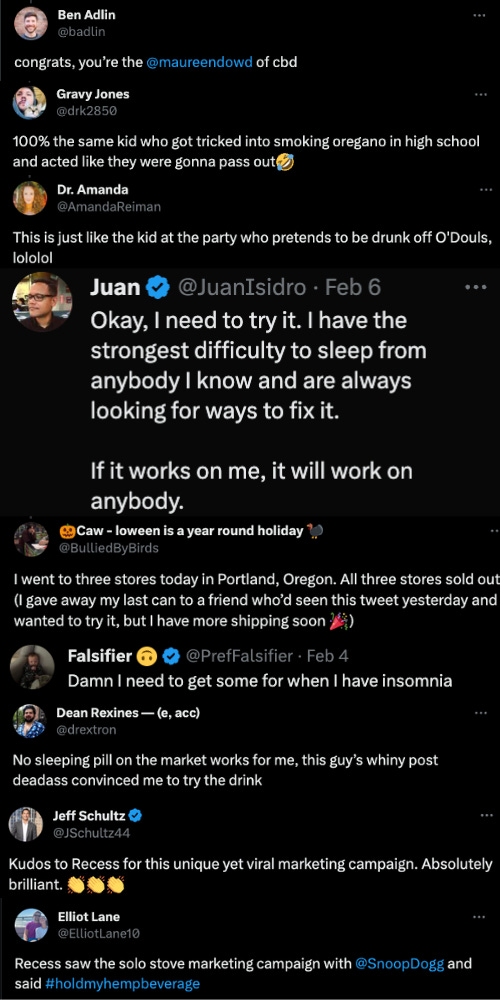

The original post drew reactions immediately — ranging from some light ribbing and ridicule to genuine appreciation from folks who said they could use help sleeping — and one person who even said they visited three stores in Portland, only to find them all sold out!

In total, this tweet had driven nearly 15 million views between when it was originally posted last Monday morning and Thursday night when I took this screenshot!

Not bad considering Recess says they didn’t pay for this viral moment and seemingly had nothing to do with the original tweet.

After seeing this follow up below from Justin Murphy (the dude who sent the original tweet) saying he was being ignored when asking for a hook up, I reached out with a few questions.

Here is what I asked:

1) Was that a serious or satirical tweet?

2) Did you tweet that unprompted/unpaid by the company?

3) Have they still refused to send any sort of free product as a thank you?

Thankfully, Justin got back to me pretty quickly. He confirmed that after consuming two Recess drinks, he indeed slept for 11 hours, which resulted in him missing mass. He also mentioned that he wasn't compensated, and there was no prior coordination with Recess before making the post.

He said he knew it would go viral because he had a similar tweet months ago that also went viral — so he decided to lean into it.

So it sounds like Justin isn’t actually a prohibitionist, but he should be an in-demand influencer!

I also reached out to the team at Recess to ask them how they felt about this viral moment and it sounds like they were as confused as the rest of us saying that they were “a bit surprised” and a little confused about him talking about the dangers of marijuana despite there not being an THC in the drink.

But the big question is did the virality lead to sales?

While I wasn’t able to nail down any sort of sales numbers, they said they “definitely noticed a surge in website traffic and inquiries” after the tweet.

Justin also mentioned that the CEO of Recess ended up reaching out and offering a few cases as a thank you, which seems like the least they could do after such a great week.

Even as someone who doesn’t consume cannabis beverages and who consumes enough THC on the daily that 20mg of CBD isn’t going to do anything for me, I’m more inclined to buy a Recess if I ever see one at the store after watching this unfold.

Key takeaways:

Organic Reach is Gold

Authenticity Connects: Genuine, unscripted stories captivate audiences far more than polished ads.

The Power of Ambiguity: The blend of serious and satirical tones in the post sparked curiosity and debate, fueling its viral spread.

Unintentional vs. Intentional Messaging: Had Recess itself claimed their drinks promote better sleep, the message might have gone unnoticed. The organic, user-generated nature of the tweet propelled it to millions.

Earned Impressions Wayyy Cheaper Than Paid Ads: With the average CPM for Twitter advertising at around $3.11 in January 2024, according to Gupta Media, it would have cost Recess $46,000+ to reach 14.8 million people.

Here is that math break down:

14,800,000 views divided by 1000 = 14,800 mille x $3.11 CPM = $46,028

Hidden Influencers Matter

Depth Over Breadth: True influence lies not in vast follower numbers, but in meaningful engagement with the audience.

The Unintended Spokesperson: Regular users can become powerful brand advocates, often without any intention, highlighting the impact of relatable content. Sure, this account had 37k followers, but he’s not exactly out of central casting for weed influencers either.

Trust is the Ultimate Currency

The Might of Reviews: Testimonials from customers often hold more sway than elaborate advertising campaigns.

Authenticity Engenders Loyalty: Real, shared experiences by users encourage trial, purchase, and recommendations far more effectively than direct brand promotions.

The one last thing that is worth mentioning: the best marketing is and always will be… having a good product.

I want to give a special shout out to these awesome sponsors who are supporting our newsletter even in our infancy.

If your company/brand is interested in sponsoring, please reach out!

Reader Poll:

When I decided to relaunch CannabisCMO last month, I defaulted to sending out this newsletter on Friday…but I’m still experimenting.

What day of the week do you want to see the latest edition in your inbox?

Cannabis beverage brands capitalized on Dry January interest - Modern Retail

Cannabis beverages are carving out a significant niche in the Dry January movement, offering a non-alcoholic buzz for those abstaining from alcohol. Brands like New York's The Travel Agency and Ayrloom have noted an uptick in sales of THC and hemp-infused drinks, attributing this to their appeal as social substitutes for alcohol. The sector has seen explosive growth, with cannabis beverages increasing from 1% of all legal cannabis sales in 2021 to nearly 4% in some markets in 2023. Companies have leveraged Dry January's popularity to reach health-conscious consumers, with campaigns like Cann's "Cannuary" driving significant revenue spikes. Despite challenges in advertising and distribution, the cannabis beverage industry sees Dry January as a pivotal moment to attract new customers, promising a low-calorie, fast-acting alternative to traditional alcoholic drinks and mocktails.

My thoughts:

Dry January seems to be here to stay. One estimate from Bloomberg showed that alcohol sales dropped by 52% from the first week of January last year to the first week of January this year.

It was interesting to read about Ayrloom’s background coming from hard cider and how they had seen several years of steady January sales declines before they began to invest in other non-alcohol beverages including their line of THC drinks.

This was one of the first year that I saw several brands (including non-beverage companies) with proactive campaigns ready for Dry January.

ThndrStrm Strategies client Berkshire Roots also got in on the fun running a “High January” campaign where they encouraged their customers to “invite cannabis to happy hour” and enter for a chance to win a tour of their grow.

This wasn’t the only headline that focused on Dry January and its intersection with the cannabis industry over the last couple of weeks. Here is one from Bloomberg that caught some attention.

I saw one LinkedIn user Rick Bashkoff post about this headline that was trending on the platform earlier this week, as well as the following response from Scott Vickers of Headset which seems to call into question exactly how much of a “sales boom” it was in January.

Given our coverage of this week’s viral Recess campaign coupled with positive reviews from Dry January, I think it’s safe to say we are still at the beginning phases of the cannabis beverage category.

Only 0.05% of Posts on Meta Violate Their Policies - So Why Is The Cannabis Industry Still Being Targeted? - PufCreativ

In a recent LinkedIN article by PufCreativ, it's revealed that the cannabis industry faces disproportionate challenges on Meta platforms due to strict content policies. Despite Meta's data showing only 0.05% of Facebook content violates its restricted goods policies, cannabis-related posts are frequently flagged, suggesting targeted enforcement by algorithms. PufCreativ's exploration into Meta's Transparency Center data underscores a systemic issue, where cannabis content is unfairly categorized with more strictly regulated substances. This misclassification leads to inconsistency in policy enforcement, impacting cannabis businesses' ability to operate effectively on social media. The findings advocate for a more nuanced approach to content regulation, urging the cannabis industry to adapt its strategies and push for fairer treatment on Meta platforms.

My thoughts:

As cannabis marketers we intimately understand the tension that is constantly present while trying to build brands on social media platforms that are regularly targeting our accounts with sophisticated content moderation A.I.’s. but I really appreciate Ali Hinman and the PufCreativ team for taking the time to dive into the data that affirms what we’ve all feel.

One of the key data points that this article points out is that only 0.05% of all posts on Facebook actually violate their “restricted goods and services” policy.

For those of us who are mathematically challenged, that means out of every 10k views of content on Facebook, they estimate that just 5 of those views contained content that violated the policy.

Another interesting piece of information gleaned from the data was that while “marijuana” has its own category under the restricted goods and services policy, it gets lumped into the overall data for the “drugs” category, which makes it hard to get specific data on marijuana related content that is being cracked down on.

One of the biggest takeaways for cannabis marketers is that only 2.7% of actioned posts (posts that were removed for violating policies) on Facebook (and 0.40% on IG) were actually reported by users!

“This data shows how much Meta relies on algorithms and artificial intelligence to monitor and manage posted content. And, if the algorithm is told to look for “drugs” without the nuances of including the legal cannabis landscapes, this means that cannabis businesses and marketers will continue to be targeted. - Ali Hinman, Director of Written Content @ PufCreativ

I know a lot of marketers are excited about a potential Schedule III determination this year, but I wouldn’t expect social media platform lawyers to loosen up restrictions until things are fully de-scheduled. So stay vigilant.

How Do You Make a Weed Empire? Sell It Like Streetwear - New York Times

Cookies, the cannabis and streetwear brand renowned for its potent weed and cultural cachet, is expanding its footprint from the West Coast to new markets, including a recent opening in New Jersey. Founded by Berner, a rapper and former marijuana dealer, Cookies has grown from underground beginnings to a mainstream powerhouse, embodying the intersection of startup culture and streetwear. The brand's appeal extends beyond its product to embody a lifestyle, resonating with consumers through its story of rebellion, entrepreneurship, and the blurring lines between legality and the legacy market. With 64 locations worldwide, Cookies stands at the forefront of the legal cannabis movement, leveraging its origins and Berner's dual identity as a rapper and cannabis mogul to cultivate a unique market position reminiscent of streetwear giants like Supreme. This expansion not only marks Cookies' growth but also highlights the evolving landscape of legal cannabis, where authenticity and brand narrative play crucial roles in consumer engagement.

My thoughts:

Cookies is hands down the biggest brand in cannabis.

They may not have the most stores, the highest volume of sales or have raised the most money, but I’m not sure there is another truly "national” brand that could be named by consumers in every state — irrespective of whether their flower is even available in their state.

While Berner’s story is unique to himself and no one will ever be able to recreate his exact formula for success, I do believe that there is a lesson to be learned for the power of authenticity when building a brand. Especially for legacy operators who are making the transition into the regulated marketplace.

“Most of the MSOs, I think, are companies first trying to build brands, and then we were a brand first, trying to build a company around the brand,” - Parker Berling, President of Cookies

As I’ve mentioned before, all the marketing in the weed can’t save a soulless weed brand. The reason why Cookies is as big as they are is because the product speaks for itself.

Cannabis Industry Blogs + More Headlines:

Can Mike Tyson Become a Heavyweight in the New York Marijuana Industry? - New York Times

GreenState cannabis rankings: best brands in Massachusetts - Green State

New restrictions in adult-use cannabis markets ‘not conducive to business’ - MJBizDaily

Secrets to Retail Success in 2024 - MG Magazine

1906 Edibles to Exit Colorado Marijuana Market - Westword

Infographic of the Week:

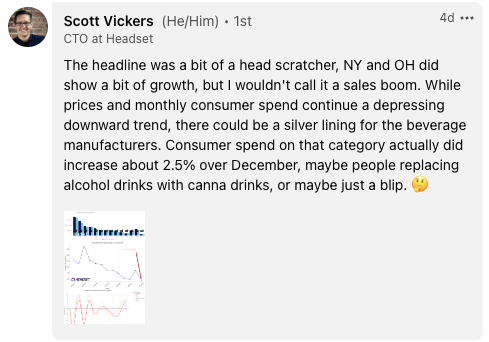

In this infographic from New Frontier Data, it shows data gathered from a 2023 survey of 5,500 adults in the U.S.

It specifically shows the gap between the number of consumers in each age range and the age demographic of those who regularly frequent dispensaries to purchase their products.

The data shows that dispensaries are missing out on a lot of consumers over 34 because they don’t fall into the typical marketing channels for dispensaries.

To learn more, download New Frontier Data’s report: Cannabis Consumers

in America 2023 - Growing the Legal Market: Expanding the Consumer Base

Mainstream Marketing Chatter:

Social Media Is Getting Smaller—and More Treacherous - Wired

Google Tests New Generative AI Recommendations for Search Campaigns - Social Media Today

Labeling AI-Generated Images on Facebook, Instagram and Threads - Meta/FB

TikTok is facing its own Napster moment - Fast Company

CMOs are facing an existential crisis — but there is still time to secure the future of marketing - Business Insider

Keep In Touch:

Thanks for reading another edition of #CannabisCMO!

If you like what you are reading, there are three things you can do to help us grow:

Follow us on LinkedIN

Subscribe to CannabisCMO YouTube channel

Share this newsletter with a friend

Become a paid subscriber today!

As always, please feel free to leave some comments here on Substack, shoot us a message on our LinkedIn page or reach out directly to kaliko@thndrstrmstrategies.com