What Are The Top Brands in the Cannabis Industry?

Exploring some subjective and objective criteria for identifying the top cannabis brands.

Over the last couple of months, you may have seen a lot of 2023 wrap-up articles talking about the top brands in the cannabis industry — which got me wondering — what are some of the ways that we determine who are the best brands in cannabis?

To start off, I think it’s helpful to define what a “brand” is.

I actually really like this definition from Seth Godin:

“A brand is the set of expectations, memories, stories and relationships that, taken together, account for a consumer’s decision to choose one product or service over another. If the consumer (whether it’s a business, a buyer, a voter or a donor) doesn’t pay a premium, make a selection or spread the word, then no brand value exists for that consumer.”

As we talked about recently in our conversation with George Jage from MJUnpacked, the importance of a strong brand in the cannabis industry, can be the deciding factor between engaging in a price war and establishing a brand that commands its own price no matter the fluctuations in the marketplace.

A strong brand transcends products or services it may sell; it embodies a promise and a consistent experience that resonates deeply with consumers, influencing their loyalty and willingness to pay a premium.

In a market as commoditized as cannabis, where differentiation can be challenging, a robust brand strategy becomes not just beneficial but essential. It's about creating a unique identity, one that speaks directly to consumers' values, preferences, and experiences, ensuring your brand isn't just another choice but the choice.

When trying to capture the value of a brand, here are a five ways that properly investing in your brand upfront can help your business:

Differentiation: In a saturated market, a strong brand helps differentiate your products from competitors, making it easier for consumers to choose your brand over others.

Loyalty: A memorable brand builds emotional connections, fostering loyalty among consumers who then become repeat customers and brand advocates.

Premium Pricing: Brands that successfully convey quality, reliability, and appeal can command higher prices, increasing profitability without competing on price alone.

Market Positioning: A well-defined brand allows for better market positioning, targeting specific consumer segments with tailored messages that resonate more effectively.

Resilience: Strong brands are more resilient to market fluctuations and regulatory changes, maintaining customer trust and continuity even in challenging times.

However, embracing Seth Godin's definition invites us to explore beyond traditional metrics and delve into the nuanced, subjective qualities that truly set a brand apart. It's about capturing those intangible elements—expectations, memories, stories, and relationships—that resonate on a personal level with each consumer.

Subjective Ways to Measure Brand:

Brand Story and Identity: How well does the brand communicate its mission, vision, and values?

Product Quality Perception: Customer opinions on the quality and effectiveness of products.

Customer Loyalty and Engagement: The strength of the brand's community, repeat customers, and social media interaction.

Aesthetic Appeal: Packaging, branding materials, and overall visual identity.

Transitioning from these subjective aspects, let's consider the objective ways to evaluate a cannabis brand's success. These metrics offer a tangible means to measure impact, reach, and market presence, providing a balanced view of a brand's overall health and potential for long-term success.

Objective Ways to Measure Success:

Market Share: The brand's share of the market in relevant regions or categories.

Sales Growth: Year-over-year or quarter-over-quarter sales figures.

Product Availability: Distribution scope across retail locations and states.

Social Media Metrics: Followers, engagement rates, and content reach.

Media Coverage: Volume and sentiment of earned media.

Awards and Recognitions: Industry awards or certifications for product quality, innovation, or business practices. Be careful, though. There is a fine line between objective and subjective awards.

Together, subjective insights and objective data paint a comprehensive picture of what makes a cannabis brand not just survive, but thrive in this competitive landscape.

Last year, CannabisCMO covered Pioneer Intelligence’s list of the top social media brands in cannabis. This year, they are out with eight infographics highlighting the top brands (broken down by MSO and non-MSO) across Earned Media, Social Media, Web Activities and Overall Marketing.

This first set of “hottest brands” is focused on MSO’s and there are some usual suspects (Curaleaf, Cresco, Cookies, Wana, Wyld, etc) in most of these categories as well as others that may not be as well known depending on what market you reside in.

This second grouping is focused on smaller brands and isn’t meant to include MSO’s but when you see brands that are connected to MSO’s, like NETA and Surterra Wellness — both of which are owned by Parallel, you have to wonder how strict the criteria is. Even “smaller” brands with cult followings like Alien Labs and Jungle Boyz could be considered MSO’s at this stage in the game.

What do you think about these rankings? Do you agree with them? Leave a comment and sound off!

While I can imagine some of the critiques about these rankings (and I’ve seen some on LinkedIN recently), Pioneer Intelligence stands out in the cannabis industry with their proprietary methodology, crafting a unique, objective lens through which they measure brand performance.

One of the most common pieces of feedback I’ve seen about these rankings is that when measuring earned media or social media mentions, it doesn’t factor in negative vs positive sentiment.

Some folks noticed brand names like Skymint and MedMen on the list were more likely to have made the earned media list due to the fact that a “dumpster fire is pretty hot too” (as Dan Russell put it on LinkedIN), not how well their brand was faring with consumers in the market.

For their part, Pioneer Intelligence has been sure to make their methodology transparent, including mentioning that “sentiment plays no role here” and that their system “values good news and bad news the same”.

For more information about their methodology, here is language directly from their website:

Our database, which was created in 2017 and now grows by more than 100,000 data points each week, aggregates metrics which track brand marketing performance through three silos: web-related activities, social media and earned media. This still-expanding index currently includes more than 750 brands operating in 32 states.

A proprietary, comparison-based scoring system evaluates cannabis brands, their marketing activities and digital properties. Our weighted-features construct includes metrics and measurements commonly employed when evaluating consumer-facing brands, but is built with the nuances of cannabis marketing in mind. A recency bias in the index slightly favors relative change, or delta, over absolute position, and our algorithm is designed to account for size: enabling mono-state, single-product sellers to stand alongside multi-state operators with more expansive product offerings.

Six months of historical data is required before a brand can be included in the index. Also, changes made to website URLs and social media handles, including temporary account suspensions, can impact results.

Our index is not fixed. Our data collection efforts continue to expand and our feature-weightings are periodically adjusted in order to ensure we remain an effective, unbiased measure of performance across our industry.

Transitioning from the insightful and innovative methodology used by Pioneer Intelligence, which focuses on a brand's marketing performance across web activities, social media, and earned media, another significant dimension to measuring the success and impact of cannabis brands emerges through real-time data analysis.

This is where Headset's approach becomes particularly relevant and compelling.

Unlike the broader marketing metrics, in their recent blog The 2023 Fastest Growing Cannabis Brands Headset offers an objective, quantitative measure of brand performance by leveraging actual sales data directly from point-of-sale (POS) systems.

Here is some more info about Headset’s data methodology:

The top 10 list below represents the brands that had the largest year-over-year percentage growth from 2022 to 2023. Headset data is sourced from the point of sale systems of more than 3,000 of our cannabis retailer partners. This data represents more than $24 billion in directly-measured sales across all US cannabis markets. These brands stood out against a slate of more than 7,000 others in the United States that are monitored every day within Headset Insights. In order to qualify, a brand must've had more than $100,000 in sales in 2022 and products on store shelves for each month of 2023

This approach by Headset provides a concrete, data-driven perspective on how brands are performing in the market, offering insights into consumer behavior, product preferences, and purchasing trends.

By analyzing real-time sales data, Headset allows stakeholders to see beyond the noise of marketing campaigns and earned media to understand what products are truly resonating with consumers.

This data not only reflects the financial health of cannabis brands but also sheds light on the effectiveness of their product offerings, pricing strategies, and distribution networks.

By incorporating Headset's sales data analytics into the conversation, we bridge the gap between subjective brand perception and objective market reality. It enriches our understanding of brand success by adding a layer of tangible evidence that reflects actual consumer choices and preferences at the point of purchase.

This integration of real-time sales data offers a comprehensive view of a brand's market presence and consumer appeal, providing a crucial tool for companies looking to navigate the competitive landscape of the cannabis industry effectively.

Isn’t it fascinating how little overlap there is between these two systems of evaluating brand success?

While Pioneer Intelligence's methodology gives us a valuable lens through which to view brand marketing performance, Headset's use of actual sales data from POS systems and it’s focus on year over year growth introduces an indispensable, objective measure of how these brands translate marketing efforts into actual sales and market share.

Together, these approaches offer a well-rounded perspective on what to consider when putting any weight into various “top brands” lists across the internet.

I want to give a special shout out to these awesome sponsors who are supporting our newsletter even in our infancy.

If your company/brand is interested in sponsoring, please reach out!

Did you know that CannabisCMO is partnered with Marijuana Moment to offer special discounts to our readers on advertising in their newsletter and on their website?

Interested in getting in front of 80k active subscribers + millions of readers who come to MarijuanaMoment.net for the latest cannabis industry and advocacy news?

Social media’s bad week: Outages at Facebook, Instagram, Threads, LinkedIn, Reddit, and Truth Social - Fast Company

In a tumultuous week for social media, nearly every major platform experienced outages, sparking a flurry of conspiracy theories linking the downtime to significant American political events. Facebook, Instagram, and Threads—Meta's social media trio—went offline on Super Tuesday, a crucial day for presidential primaries, while former President Donald Trump's Truth Social platform faltered during President Biden's State of the Union address. LinkedIn and Reddit also faced their share of technical difficulties. Meta attributed their outage to a "technical issue" without further details, LinkedIn apologized without explanation, and Reddit addressed slow load times and errors without specifying causes. Interestingly, X (formerly Twitter) remained operational, with owner Elon Musk taking the opportunity to highlight his platform's reliability amidst competitors' failures.

My thoughts:

Aside from the conspiracy theories about the fact that almost every major platform went down the same week as Super Tuesday and the State of the Union, the most important takeaway is that any of these platforms could go down at anytime — so if your brand’s marketing strategy is entirely dependent on channels you don’t own (like social media channels), you need to diversify your portfolio and lock down your contact list…like, yesterday.

What if your largest social platform went down on the day of your store’s grand opening and you weren’t able to post about it? What would you do to get the word out? This is why even if you have a large following on Social Platform XYZ, you should be working to convert those followers into your email or text marketing list.

Please let this be a flashing red light reminder that you should start converting your social followers into email/text contacts today!

HOW AMERICAN WEED CO.’S PRESENTING SPONSORSHIP MADE HISTORY AT CALI VIBES - Event Marketer

American Weed Co. broke new ground at Cali Vibes 2024 as the first cannabis brand to sponsor a major U.S. music festival, highlighting its mission to destigmatize cannabis and advocate for veterans' rights. Without selling cannabis due to regulations, they engaged attendees through a unique setup that included a merchandise storefront, a military locker turned into a speakeasy-style tattoo parlor, and a lounge offering a relaxed viewing experience of the festival's top acts like Gwen Stefani, Ice Cube, and Wiz Khalifa. This innovative approach not only brought attention to the brand's commitment to community and veterans but also set a precedent for the future involvement of cannabis brands in large-scale public events, marking a significant step towards mainstream acceptance.

My thoughts:

Not a lot of people know this but I actually had a weekly reggae podcast back when I was an intern for NORML called the Irie Island Hour and regularly attend the Cali Roots Festival (another well known reggae focused festival) in Monterey— so this story definitely caught my eye.

Although I’m not sure that American Weed Co. is the first cannabis brand to sponsor a *major* music festival (I remember seeing Jahlibyrd be the headline sponsor of Cali Roots pre-pandemic), I do think we’ll start to see more cannabis companies sponsoring more mainstream cultural events in the near future.

Looking at the photos and reading the description of this activation, it seems like it was super effective and likely grew their brand awareness with an audience that is receptive to their message and their mission.

I especially liked their idea to have a military-style locker open up into their speakeasy lounge right next to the main stage. A cool activation that is authentic to a brand focused on veterans and operating in an industry still mired in decades of prohibition.

One thing that will need to be kept in mind for cannabis brands sponsoring events in some states is the fact that some require cannabis companies to verify that a certain percentage of the attendees are over 21.

For instance, New Jersey adopted a 71.6% threshold and requires that a licensee maintain records to prove that your advertising is in compliance.

Here is what New Jersey’s marketing and advertising regulations say:

A cannabis business that advertises shall keep records as reliable evidence that the advertisement meets the requirements of this subchapter, which shall be available, upon request, to the Commission.

Such records shall include a precise description of the audience that is reasonably expected for an advertisement, and a list of all publications and venues in which an advertisement was published.

Marijuana Rolling Paper Company Seeks Content Creator To ‘Get Paid To Smoke Weed’ For $70,420 Salary - Marijuana Moment

Custom Cones USA, a marijuana company, is embracing the “ultimate stoner dream job” by hiring a content creator for its new brand DaySavers, offering $70,420 for the role that includes social media creation, event marketing, and cannabis product testing. CEO Harrison Bard emphasizes the search for a unique individual passionate about cannabis to generate engaging online content. The full-time position promises all-expenses-paid travel to marijuana events, with applications open until April 20. However, the role demands expertise in social media content management beyond just enjoying cannabis.

My thoughts:

Before I had kids, this would have definitely been my dream job.

I had a chance to stop into the Custom Cones USA booth at MJBizCon this year and was pretty blown away by all of the various options that they had on display. They even had a crucifix looking cross joint that comes in a box reminiscent of a coffin.

At $70k/yr along with all-expenses paid trips to the various trade shows in the industry, this is a totally legit opportunity for someone to help get their Daysavers brand out into consumer’s hands while building a name for themselves and an awesome portfolio.

I look forward to seeing whoever gets this position and following along with their content journey!

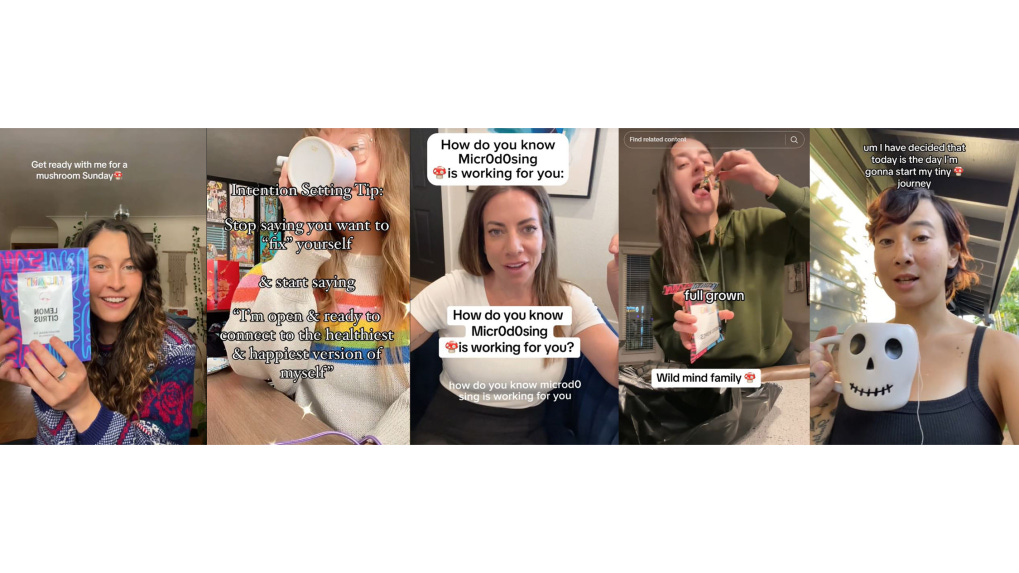

Marketing magic: How influencers are helping sell psychedelics to social media masses - Denver Post

In a move that mirrors the burgeoning trend of influencer marketing in various industries, psilocybin mushroom companies are increasingly turning to social media influencers to promote their products amidst legal ambiguities. This method of marketing, though innovative, navigates a gray area in states like Colorado, where psilocybin has been decriminalized but not fully legalized, particularly for commercial sale. Influencers and affiliate marketers, offering discount codes and personal testimonials, help bridge the gap between curious consumers and psilocybin products, despite the legal risks involved. This trend highlights a shift towards digital platforms as a vital space for promoting substances that remain on the fringes of legality, underscoring the complex intersection of social media, commerce, and psychedelic advocacy.

My thoughts:

It’s not necessarily a surprise that people use the internet to source and buy illicit drugs but given how much trouble cannabis influencers often find themselves with these social platforms, I had to do a double take when reading about how many followers some of these psilocybin/psychedelic influencers have.

Given that it is entirely illegal to sell psilocybin mushrooms across the country, this economy is happening entirely underground but very much out in the open.

The sophistication and organization it takes to set up and track an affiliate program shows that these companies are not just street dealers with websites.

As legislation continues to be introduced in various states and localities, we will see a lot more influencers helping to market products in the psychedelic industry.

It looks like cannabis influencers might want to take some notes from those who are already on the cutting edge of another proto-legal industry.

Cannabis Industry Blogs + More Headlines:

Bay Area cannabis shops are closing as pot sales slump - SF Gate

New York’s Cannabis Marketing Rules Need Rethinking for Small Business Success - Stupid Dope

86% of Californians who consume cannabis believe it is important to shop legally - California Department of Cannabis Control

Infographic of the Week:

This month is Women’s History Month and this week was International Women’s Day so we thought we’d highlight this infographic from New Frontier Data.

According to a recent survey they conducted, the findings vividly illustrate how women are embracing cannabis as a holistic strategy to enhance their overall well-being.

Notably, an impressive 96% of women employing cannabis for women's health concerns attest to its effectiveness, with 40% describing it as very effective.

This data underscores the increasing acceptance and efficacy of cannabis as a holistic solution for women's health and wellness.

Cannabis brands would do well to make sure you are marketing to women, who make up half the population.

Mainstream Marketing Chatter:

How to supercharge your marketing strategy with AI automation - Sprout Social

You can finally edit your Instagram DMs - Mashable

Anthropic releases more powerful Claude 3 AI as tech race continues - Reuters

Wendy’s Surge Pricing Is Off the Menu After Internet Beef - Gizmodo

Wrap Up:

Thanks for reading another edition of #CannabisCMO!

If you like what you are reading, there are three things you can do to help us grow:

Follow us on LinkedIN

Subscribe to CannabisCMO YouTube channel

Become a paid subscriber today!

As always, please feel free to leave some comments here on Substack, shoot us a message on our LinkedIn page or reach out directly to kaliko@thndrstrmstrategies.com